Episodes

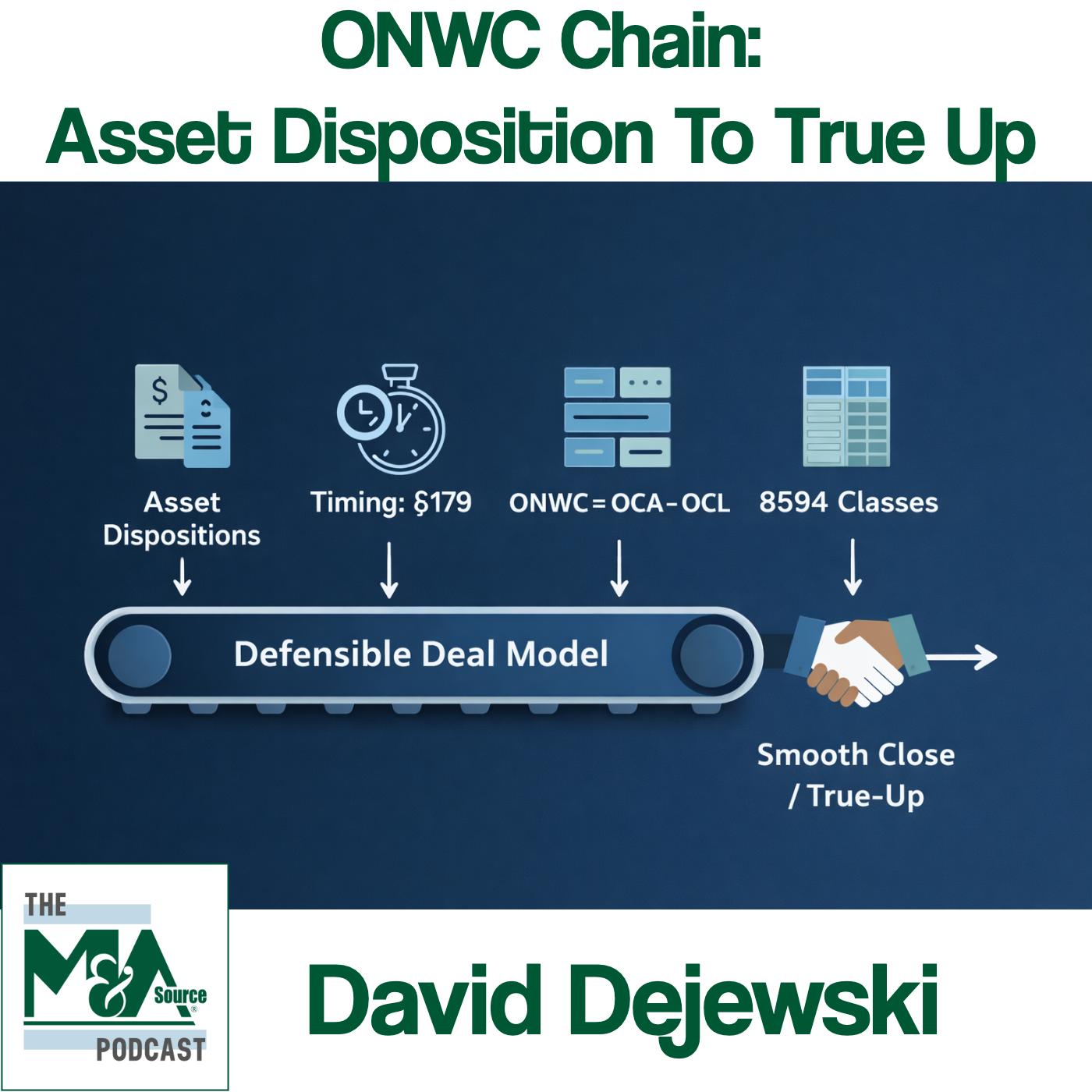

ONWC Chain From Asset Dispositions to True Up

In this episode, we connect asset dispositions (Form 4797), depreciation timing and Section 179 (Publication 946 / Form 4562 support), operating net working capital (process-first peg method + dollar-for-dollar true-up), and asset allocation reporting (Form 8594 residual method). We focus on buildi…

Inside the Spring 2025 M&A Source Conference: A Conversation with Jac…

Connect with Us and Access Show Resources: https://snip.ly/mas_interact28 What does it take to design one of the most meaningful gatherings in the M&A industry? In this episode, host David Dejewski sits down with Jaclyn Ring ...

Stock Certificates and Ledgers: Reconstructing Ownership

Connect with Us and Access Show Resources: https://snip.ly/mas_interact27 In this episode, David introduces a recent M&A deal that was delayed due to issues with stock certificates and ownership records. He sets up the episod...

Unpacking Lease Analysis: A Key to Transaction Success

Access Show Resources: https://snip.ly/MASPodcastResources Connect With Us: https://snip.ly/mas_interact26 Episode Summary: In this episode of the M&A Source Podcast, host Dave Dejewski dives into the critical topic of lease ...

Top 10 Tax Code Provisions to Leverage in M&A (Part 2)

Interact with the show: https://snip.ly/mas_interact25 In this episode of the M&A Source podcast, Dave Dejewski continues a series on essential tax code provisions for mergers and acquisitions, discussing five additional prov...

Top 10 Tax Code Provisions to Leverage in M&A (Part 1)

Interact with the show: https://snip.ly/mas_interact24 The episode discusses 10 key tax code provisions relevant to mergers and acquisitions (M&A) transactions. It is divided into multiple parts, with Part 1 covering the foll...

Fall 2024 Conference Preview

The M&A Source fall conference is a premier event for M&A professionals, focusing on larger deals in the lower mid-market. Hosted by Dave Dejewski, this podcast episode features an in-depth interview with Kathlene Thiel, the conference committee chair, who provides a comprehensive overview of the e…

Cross Border Accounting with Katrina Nacci

Links: Visit the Show: https://podcast.masource.org Become a member or register for a class or event: https://masource.org Summary of this Episode Introduction to US GAAP and its importance for companies expanding into the US...

Essential Business Performance Metrics for M&A Advisors

Interact with the show: https://snip.ly/mas_interact21 Share your origin story In this episode of the M&A Source podcast, Dave Dejewski dives deep into essential business performance metrics that significantly impact business...

Business Valuations with Shelia Darby

Visit us at https://podcast.masource.org In this episode, Shelia Darby, Managing Director of Bizworth, discusses the importance of accurate business valuations in M&A transactions, the different valuation methodologies, chall...

Beyond Numbers: Unveiling the Tax Puzzle in M&A Transactions with Rom…

In this tax-season special episode of the M&A Source Podcast, we delve into the fascinating world of taxes within the mergers and acquisitions space. Our guest, Roman Basi, a seasoned attorney, CPA, and real estate broker, sh...

Spring 2024 Conference Overview

In this short community update, hear from Kathlene Thiel, our 2024 Conference Chair as she explains our agenda and what you can expect from this Spring conference.

2024 M&A Source Member Benefits with Russell Cohen

Visit the show notes at https://podcast.masource.org Visit M&A Source at https://masource.org In today's episode of the M&A Source Podcast, we discuss the myriad benefits that M&A Source offers to its members with Russell Coh...

Anatomy of a Purchase Agreement with Matt Bowles

Welcome to our latest episode of the M&A Source Podcast. In this episode, we dive deep into the world of Purchase Agreements with our esteemed guest, Matt Bowles, an attorney at Hogan Lovells. Here's what you'll discover in this insightful discussion:I...

Working Capital with Ryan Hurst

In this episode of the M&A Source Podcast, host Dave Dejewski is joined by Ryan Hurst, an expert in financial consulting, to discuss the complexities and significance of working capital in mergers and acquisitions.

Meet the Chairman: Scott Mashuda and M&A Source in 2023

Scott Mashuda, a founding Partner of River’s Edge Alliance Group and M&A Source’s Chairman-elect, discusses his background and what he’s excited about for M&A Source in 2023.

Rich Jones (Zabel Companies) and Bob McCormack (Murphy McCormack Capi…

Rich Jones (Zabel Companies) and Bob McCormack (Murphy McCormack Capital Advisors) Discuss Building Trust between Entrepreneurs and Equity Partners

Rich Jones (Zabel Companies) and Bob McCormack (Murphy McCormack Capi…

Rich Jones (Zabel Companies) and Bob McCormack (Murphy McCormack Capital Advisors) Discuss Building Trust between Entrepreneurs and Equity Partners

Key Private Bank - Strategies for Tax Efficient Business Transitions …

Lamar Stanley of Lead Capital Partners chats with Joel Redmond and Kalimah White of Key Private Bank about techniques that they use in their business advisory practice to help business owners reduce tax exposure in transactions.

Key Private Bank - Strategies for Tax Efficient Business Transitions …

Lamar Stanley of Lead Capital Partners chats with Joel Redmond and Kalimah White of Key Private Bank about techniques that they use in their business advisory practice to help business owners reduce tax exposure in transactio...

Live Oak Bank: Financing and Structure for Lower Middle Market Deals …

Lamar Stanley of Lead Capital Partners chats with John Wahl of Live Oak Bank about what makes Live Oak different and how they structure lower middle market deals. In the interview they discuss the history of Live Oak, and John’s work in SBA lending,

Meet the Chairman: Jeff Swiggett and M&A Source in 2022

Meet the Chairman of M&A Source 2022, Jeff Swiggett

Meet the Chairman: Jeff Swiggett and M&A Source in 2022

Meet the Chairman of M&A Source 2022, Jeff Swiggett

John Dalton: Run to Own = Run to Sell

John Dalton talks about the differences between running a business to own it vs running a business to sell.