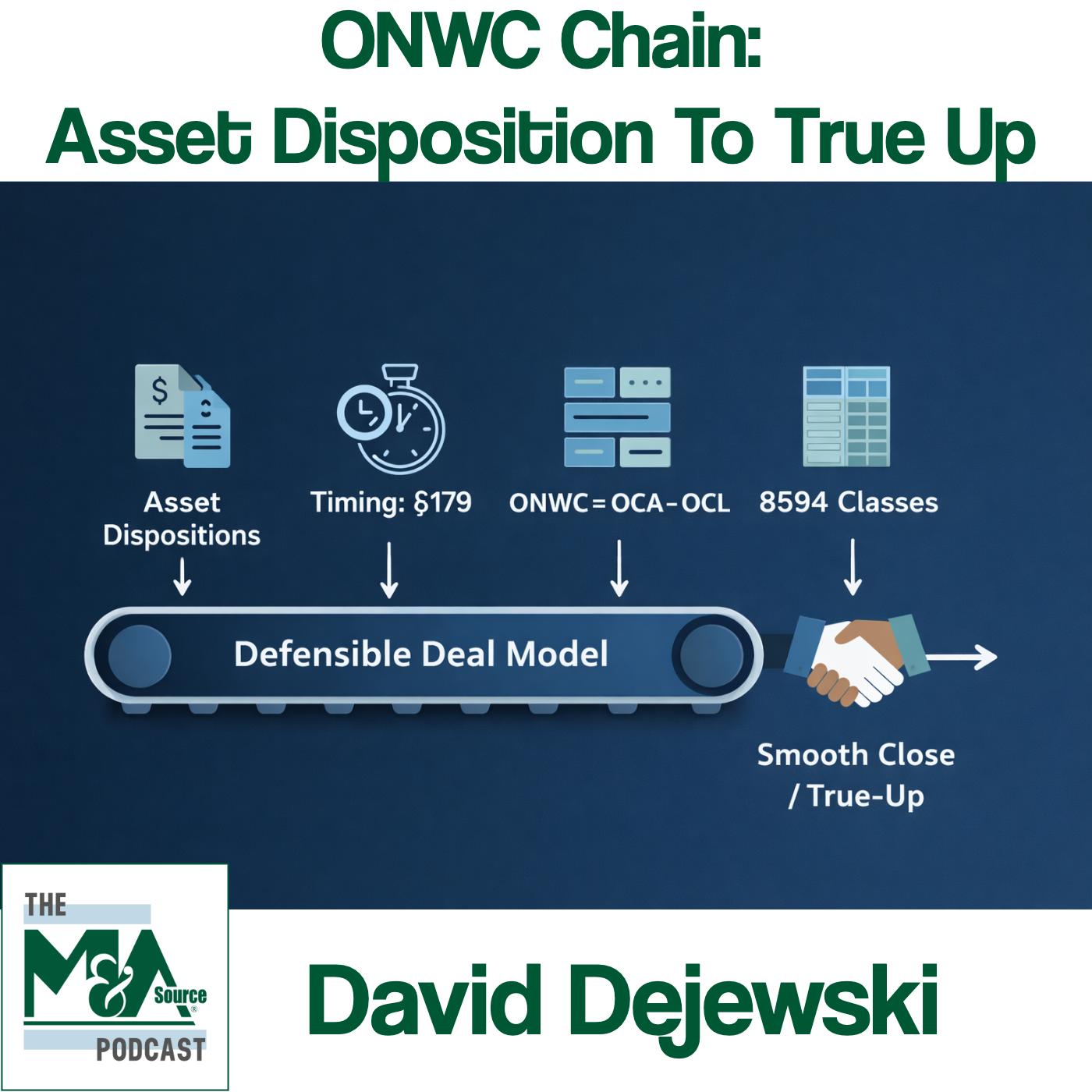

ONWC Chain From Asset Dispositions to True Up

In this episode, we connect asset dispositions (Form 4797), depreciation timing and Section 179 (Publication 946 / Form 4562 support), operating net working capital (process-first peg method + dollar-for-dollar true-up), and asset allocation reporting (Form 8594 residual method). We focus on building a defensible, repeatable approach that holds up in buyer diligence and reduces friction in LOI and purchase agreement drafting.

Connect with Us and Access Show Resources: https://snip.ly/mas_interact29

In this episode, we connect asset dispositions (Form 4797), depreciation timing and Section 179 (Publication 946 / Form 4562 support), operating net working capital (process-first peg method + dollar-for-dollar true-up), and asset allocation reporting (Form 8594 residual method). We focus on building a defensible, repeatable approach that holds up in buyer diligence and reduces friction in LOI and purchase agreement drafting.

Topics Discussed

Introduction and Problem Statement

The episode opens by identifying a common pattern in M&A deals: parties argue about working capital adjustments and purchase price before agreeing on what the numbers actually mean. Simultaneously, seller earnings appear distorted due to equipment sales, asset write-offs, or Section 179 depreciation elections. This creates confusion among buyers, sellers, attorneys, CPAs, and brokers who talk past one another. The host promises a process-first methodology connecting four critical elements: IRS Form 4797 asset dispositions, depreciation choices like Section 179, operating working capital, and asset allocation reporting.

Asset Dispositions and Form 4797

When businesses sell or dispose of property, tax reporting flows through IRS Form 4797. The key concept is "recapture," where some or all disposition gains are treated as ordinary income depending on the asset type, depreciation method, and sale price. Part 3 of Form 4797 computes ordinary income recapture based on the difference between depreciated value and disposition value. The critical valuation takeaway: disposition gains and losses distort operating earnings. A one-time equipment sale may boost income in a non-repeatable way, while disposal losses can depress earnings despite healthy operations. Applying multiples to this "noise" leads to business mispricing.

Classification Framework for Dispositions

The proper approach involves classification rather than panic. The key question: Is the business selling assets as a one-time event, or is it part of the operating model structure? Fleet-driven businesses (car rentals, delivery fleets) have planned asset turnover baked into their model—vehicles run for two years then sell on schedule. These dispositions aren't random income events but part of the business engine that will continue with the next buyer. For such cases, create a "steady state view" using averages: replacement cadence, typical proceeds, replacement capex, and recurring earnings impact. Use trailing twelve-month or seasonally adjusted numbers to model the asset cycle as normal operating pattern, normalizing to what buyers should expect going forward. This eliminates buyer skepticism by modeling rather than hand-waving.

Section 179 and Depreciation Choices

IRS Publication 946 outlines depreciation frameworks, including Section 179 elections allowing taxpayers to expense qualifying property immediately rather than depreciating over time—"rapid depreciation" with obvious tax advantages. For deal advisors, Section 179 changes timing: it can make P&L look worse when the business is healthy and investing, or make future years look artificially better because deductions were pulled forward. The solution: normalize with steady state thinking by smoothing out fluctuations to find what's normal. Ask: What level of capex and depreciation is required to keep this business operating as is? Separately address cash reality of replacements versus tax timing of deductions. When buyers claim earnings are low due to high depreciation, normalize to maintenance capex levels and steady state depreciation, applying multiples to maintainable performance, not tax timing.

Operating Net Working Capital Foundation

In accounting, "current" means expected to be realized in cash, sold, consumed, or settled within a normal operating cycle (typically 12 months)—the backbone of current assets and current liabilities. The GAAP definition of working capital is current assets minus current liabilities, which is correct but insufficient for sales processes. The deal context requires identifying what's operating versus non-operating—what contributes to business performance in the current period versus what doesn't. The core formula: Operating Net Working Capital = Operating Current Assets - Operating Current Liabilities. The word "operating" is the critical addition.

Process-First Method for Working Capital

The most important move: before discussing numbers, change the conversation early and guide everyone to agree on definitions—specifically what's included and excluded. In Main Street and lower middle market deals, operating net working capital typically excludes cash, interest-bearing debt, owner and related party items, and non-operating one-time balances unless the deal specifies otherwise. The first win is definitional clarity—you cannot have a target peg without good definitions. The process-first method: tell parties you're not picking a peg number arbitrarily; you're agreeing to a method, documenting it, and using it both early on and during true-up at closing. The default method: Target Operating Net Working Capital = average of month-end operating net working capital over trailing 12 months, calculated using the same inclusion/exclusion rules used at closing. For seasonal businesses, use seasonal schedules rather than simple averages. The closing adjustment formula: Purchase Price Adjustment = Closing Operating Net Working Capital - Target Operating Net Working Capital, adjusted dollar-for-dollar with no debate. The sequence: definitions first, method second, numbers last.

Allocation and Reporting Alignment

In applicable asset acquisitions, Form 8594 instructions describe allocating consideration using the residual method—a waterfall assigning values to asset classes with residual being goodwill and going concern value. The key advisory takeaway isn't that brokers become tax preparers, but that operating net working capital definitions agreed upon by all parties must align with how the transaction is described, allocated, and reported later. State forms (like Maryland Form 21) should match what's reported to the IRS on Form 8594, consistent across all parties to avoid audit flags from mismatched reporting. If working capital is trued up after closing, it affects final purchase price consideration and may require consistent treatment across all party reporting going forward. The host distributes a one-page letter in every package to sellers and buyers explaining this, and creates a model 8594 based on the final true-up at closing, marked as sample, suggesting parties take the model and closing documents to their tax preparer the following year. Consistent process across all parties pegged to the last true-up reduces odds that deal economics and reporting story drift apart.

Unified Framework Summary

The complete framework: (1) Normalize earnings so multiples only apply to maintainable performance, eliminating one-time gains/losses and tax timing effects; (2) Classify dispositions properly as one-time versus structural asset cycles; (3) Interpret Section 179 as timing issue and normalize to steady state; (4) Define operating net working capital as operating only, agreeing on inclusions/exclusions; (5) Set peg by agreed historical method and use same model for dollar-for-dollar true-up at close; (6) Keep included asset story consistent with proper asset allocation reporting to IRS and state. This approach reduces friction, gains credibility with sophisticated buyers, and makes transactions easier for counsel and CPAs to document. A flowchart of the four-phase process is provided via link for adaptation to individual deals.

Questions/Answers

Note: This is a monologue-style educational podcast with no explicit Q&A format. The host poses rhetorical questions and provides answers throughout. Key questions addressed:

• Q: What's the fundamental mistake parties make in working capital disputes?

A: Treating earnings normalization, working capital mechanics, and allocation reporting as separate conversations when they're all part of the same system that must tell the same story.

• Q: Is the business selling assets as a one-time event or is it part of the operating model structure?

A: This is the right classification question. One-time events get different treatment than structural, recurring asset cycles that are baked into the business model.

• Q: What level of CAPEX and depreciation is required to keep this business operating as is?

A: This is the normalizing question for Section 179 and depreciation issues, leading to separate conversations about cash reality of replacements versus tax timing of deductions.

• Q: What is operating versus non-operating in the balance sheet?

A: Operating items contribute to business performance in the current period; non-operating items do not. This distinction is critical for defining operating net working capital beyond the GAAP definition.

• Q: How do you stop fighting over the peg number?

A: Don't pick a number arbitrarily. Agree to a method, document it, and use the same method both for setting the initial peg and for the true-up at closing. Definitions first, method second, numbers last.

5 Best Quotes

• "Disposition gains and losses can distort operating earnings... If you apply a multiple to any of that noise, you're going to misprice the business."

This quote captures the core valuation risk when asset dispositions aren't properly normalized.

• "Before you start talking about numbers, change the conversation early. Guide everybody to agree on definitions. Specifically what's included, what's excluded."

This establishes the foundational principle of the process-first methodology.

• "We're not picking a peg number out of the air. We're agreeing to a method. We'll document that method... Does everybody agree that we can all work under the same set of rules?"

This reframes working capital negotiations from adversarial number-fighting to collaborative process agreement.

• "Definitions first. Method second. Numbers last. This gives attorneys something that they can draft without ambiguity."

This three-step sequence provides a clear roadmap that reduces transaction friction.

• "Your operating net working capital definitions that all parties have agreed to about what's included in the deal needs to align with how the transaction is going to be described, allocated and reported later."

This connects deal structure to tax compliance, preventing post-closing audit issues from misaligned reporting.

Tips Learned

Primary Insight: The most valuable learning is the process-first methodology that reframes working capital disputes from adversarial number negotiations to collaborative agreement on definitions and methods. By establishing the rules before calculating numbers, parties avoid the common pattern of arguing about adjustments before understanding what they're measuring.

Practical Framework: The four-link chain connecting asset dispositions, depreciation choices, operating working capital, and allocation reporting provides a comprehensive system for maintaining consistency throughout the deal lifecycle. This prevents the common problem of deal parties "talking past one another" by ensuring all elements tell the same story.

Normalization Discipline: The steady state view approach to both asset dispositions and Section 179 depreciation offers a concrete method for eliminating noise from financial statements. Rather than simply removing or ignoring these items, the framework models them appropriately based on whether they're one-time events or structural operating patterns, leading to more accurate valuations.

Risk Mitigation: The emphasis on aligning working capital definitions with tax reporting (Forms 8594 and state equivalents) addresses a frequently overlooked source of post-closing problems. Ensuring consistency across all parties' reporting reduces audit risk and prevents disputes arising from mismatched documentation.

Professional Credibility: The methodology positions advisors as sophisticated professionals who can "defend without needing to be the loudest person in the room". By focusing on process integrity rather than advocacy for specific numbers, advisors gain credibility with all parties and make transactions easier for attorneys and CPAs to document.

Actionable Tools: The episode provides specific formulas, classification questions, and a promised flowchart that can be immediately implemented in deals. The one-page letter template mentioned for distribution to buyers and sellers represents a practical tool for setting proper expectations about tax reporting consistency.

The learn more about M&A Source, please visit us at https://MASource.org

Managing Director / Host of the M&A Source Podcast

David Dejewski is the host of the M&A Source Podcast and a business leader with a diverse background in media, communications, and strategic leadership, including significant contributions to the U.S. Department of Defense. David’s media journey began in 1994 when he produced Images and Words, the Other Side of D.U.I., a 22-minute film aimed at educating young people about the dangers of drinking and driving. Supported by organizations like the US Navy and the College of Charleston, the project exemplified his early commitment to impactful communication.

David has since produced three successful podcast programs, the first of which launched in 2005 to address military healthcare leaders globally while serving as the Chief for Defense Business Transformation in the Military Healthcare System. During his tenure, he led efforts to establish a business transformation process that reviewed over $1 billion in investments, sending $200 million back to the Treasury due to redundancies or inefficiencies. David’s role was critical in aligning business IT investments with enterprise architecture, ensuring compliance, and delivering results that saved taxpayer dollars. His second podcast expanded his reach to a global audience as chair of a 501(c)(3) organization, where the show still receives hundreds of monthly downloads.

In his current role as Managing Director at Transworld Business Advisors, David specializes in problem-solving, business sales, M&A, and franchising for small and mid-market companies. His leadership extends to the M&A Source, where h…Read More